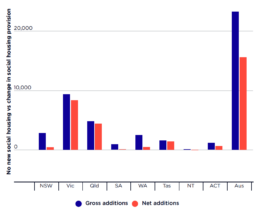

Projected social housing commencements 2021-22 – 2023-24, and projected net change in social housing provision

Despite the significant increase in overall social housing construction anticipated over the next three years, the resulting net change in provision will be inadequate to prevent a further reduction in the sector’s share of all housing, Australia-wide. According to our projections this will decline from 4.22% to 4.14% of estimated total dwelling stock over the period.

Rent changes, Q1 - Q4 2020 (agreed rents), NSW localities with extreme values & Vic statistical regions

These graphs reveal yet more contrasting intra-state rent trends during the pandemic. This analysis focuses on the first nine months of the crisis, since it was in this period that markets were most disrupted. At the NSW local government area level this period saw a marked divergence between certain regional and inner/middle ring Sydney areas.

In Victoria, meanwhile, the hit to rents in Melbourne’s inner suburbs was very similar to that experienced in inner Sydney (City of Sydney LGA). In all of Victoria’s non-metropolitan statistical regions, meanwhile, rents rose during the period – presaging further increases in 2021.

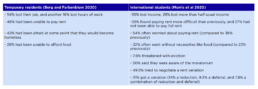

Temporary residents’ and international students’ experiences in the COVID emergency, 2020

During 2020, a significant group of temporary residents remained in Australia but excluded from the main means of absorbing the economic shock of the early emergency, and were protected primarily by the eviction moratoriums, rent variations and rent relief schemes.

Contemporary surveys of temporary residents and international students show high rates of significant hardship experienced by these groups during the 2020 emergency, as shown in this table.

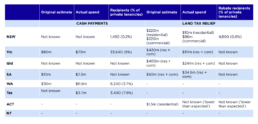

Rent relief expenditures, 2020

The available evidence is patchy but indicates that many of the rent relief schemes were significantly undersubscribed compared to original estimated costs. The NSW land tax scheme paid rebates on just 4,800 residential properties – equivalent to 0.6% of private tenancies in New South Wales. The total expended on residential rebates was $10m: less than five per cent of originally estimated expenditure (while $86m was expended on rebates for commercial properties: 40% of the original estimate) (NSW Parliament, 2021). Victoria, with its long 2020 lockdown, made cash payments to 33,640 applicants – equivalent to about 5% of Victorian private tenancies – totalling $73m (91% of the original estimated expenditure); however, its total land tax rebate expenditure was $111m, much less than the $400m originally estimated. After a significant underspend in the WA scheme, its terms were changed to pay where a landlord is offering a new fixed term tenancy at an increased rent . The ACT reports in its 2021-22 Budget that residential rebate take-up was ‘lower than expected’ (ACT Government, 2021: 105). Tasmania, having supplemented its original rent relief scheme with the landlord support scheme in late 2020, appears to have made the most extensive provision of relief, reaching a reported 3,400 recipients – equivalent to about 8% of private tenancies in that state.

Australian income support since 2000: Build back fairer, report 2

Australian income support since 2000: Those left behind. Build Back Fairer series, report no. 1

Read or download the report at: https://bit.ly/3mUYQGy

Sole parents and unemployed face poverty as nation surges ahead

The income gap between people without paid work and sole parents, and the broader community is widening, according to a new study tracking income support over two decades.

Australian Income Support Since 2000: Those Left Behind, will be launched today by the ACOSS/UNSW Sydney Poverty and Inequality Partnership to mark Anti-Poverty Week.

The report notes median household incomes have grown 45% since June 2000 with Age and Disability Support Pensions almost keeping pace.

“People receiving unemployment and single parent income support payments have been badly cast adrift,” said Dr Cassandra Goldie, CEO of ACOSS. “Those doing it toughest have been held further behind, making it that much harder to look after their health and families, as well as participate in the workforce.

“Apart from the brief period when the Coronavirus supplement was paid, the performance of the income support system during this period of robust economic growth has left whole groups of people further and further behind the rest of the community.”

Professor Carla Treloar, Director of the Social Policy Research Centre and the Centre for Social Research in Health at UNSW, said there was a clear discrepancy between different forms of income support.

“This research poses serious questions about Australia’s income support system. If it’s good enough for the Age Pension to keep pace with broader income growth we need to ask why the same principle does not apply to support for the unemployed and sole parents,” Professor Treloar said.

The Disability Support Pension has the same base payment rate as Age Pension, and so single DSP recipients similarly benefited from a substantial increase in payments in 2009.

However, that did not benefit all people living with a disability due to eligibility constraints. The percentage of people with a partial capacity to work receiving unemployment payments (rather than for e.g. the Disability Support Pension) increased from 5% in 2007 to 33% in 2021.

Eligibility constraints also affected sole parents, Professor Treloar noted.

“A series of policy changes have seen many single parents moved on to lower payment categories such as JobSeeker over the past two decades. As a result, the after-tax income of single parents receiving income support payments has plummeted since 2006.”

Link to report: https://povertyandinequality.acoss.org.au/income-support-since-2000/

Key findings

- From June 2000 to 2021, Australia’s median household income has grown by 45 % in real terms, and the minimum wage has risen by 23.5%.

- Over the same period, the single Pension rose by 52%

- For sole parents with a child under eight, their payments have risen by 27.2%, whilst the payments of those with children over eight rose by just 7.9% over the twenty year period.

- JobSeeker Payment rose by 12% in real terms, almost entirely because of the $25pw increase to the base rate in April 2021 (there was a small increase in 2013 when the Energy Supplement was introduced). The last time the base rate of the payment was lifted above CPI was in 1994 when it rose by just $2.95pw.

- The unemployment payment rate has fallen in comparison with the minimum wage since 2000 (from 50% down to 41% of replacement value), apart from the period when the Coronavirus Supplement was paid

- The percentage of people receiving the lower unemployment payment who have a partial capacity to work (who may have previously been eligible for the DSP) has increased from 5% in 2007 to 33% in 2021

- The percentage of sole parents receiving the lower unemployment payment JobSeeker has increased from 0% in 2000 to 28% in 2021.

- The payment rate of the Age Pension and the Disability Support Pension is much higher than that of JobSeeker when compared with the minimum wage.

Covid income support: Build back fairer, report 1

Covid income support: Analysis of income support in the COVID lockdowns in 2020 and 2021. Build Back Fairer series, report no. 1

Read the report and view the interactive maps at: https://povertyandinequality.acoss.org.au/covid_maps-2/

Last year we backed you, this year you’re on your own: COVID’s scorched economic path revealed

New research by the ACOSS/UNSW Sydney Poverty and Inequality Partnership reveals the deepest, most enduring economic damage of the COVID pandemic has been felt in lower income areas, like outer north-west and south-east Melbourne, west and south-west Sydney, northern Adelaide, far North Queensland and regions between Brisbane and the NSW border. These areas are also impacted by cuts to economic supports in 2021.

The Report shows that, between September 2019 and October 2020, people needing to rely on income support, who became eligible for the Coronavirus Supplement, increased by a dramatic 70%, peaking in the 2020 First Wave of the Pandemic. The Coronavirus Supplement was a vital additional payment supporting this dramatic rise in people hit by unemployment.

The Report also shows that, following the Second Wave, by September 2021, the overall number of people on these income support base payments due to unemployment is still much higher than prePandemic, by a full 27%. Yet, the vast majority of these people have not had access to any additional supports like the COVID Disaster Payments, due to much tighter eligibility.

And, as the maps available at https://povertyandinequality.acoss.org.au/covid_maps/ reveal, it is the lower income regions before the Pandemic that have also seen most dramatic increases in need to rely on income support, both in 2020, and again in 2021. The lower income areas have been hit hardest and repeatedly by the impacts of the Pandemic, and now are suffering the most from loss of paid work.

With the latest decision to end the COVID Disaster Payments regardless of the employment situation people in areas of highest financial need will be locked into poverty unless income support payments like Jobseeker are increased.

The report shows that robust COVID income support lifted many people out of paid work out of poverty. This was especially due to the $750pw Jobkeeper Payment and $275pw Coronavirus Supplement which together reached 44% of the workforce, and which meant that the number of people in poverty fell from 3 million (11.5%) before the pandemic to 2.6 million (9.9%) in June 2020.

However, more stringent support in 2021 puts those whose jobs and incomes were most deeply impacted by the Delta variant on a treacherous road to financial recovery. Both Jobkeeper and the Coronavirus Supplement were abolished in April 2021. The current COVID Disaster Payment ($750 per week) is restricted to people who lost paid work in a current lockdown. The Government has now announced its intention to even abolish Disaster Payments once overall vaccination rates reach 80%, even if further lockdowns occur or employment does not recover.

“This research paints a dire picture for those people and communities who have been left with inadequate support in 2021,” said Dr Cassandra Goldie, ACOSS CEO. “Unless we improve support now, income and social divides will fester across our major cities and outer urban areas.

“In 2020, we showed we could respond to adversity with cooperation, by providing economic security to the vast majority. Last year average incomes actually rose, despite the deepest recession in almost a century.

“But this year is a starkly different story. COVID has left a scorched economic path particularly in areas that were more disadvantaged pre-Pandemic. In so many communities, we are leaving people behind. In 2021, the Disaster Payments left gaping holes. Those who lost employment or paid hours a week before or after a lockdown have received nothing beyond the existing grossly inadequate income support payments, such as the $45 a day Jobseeker Payment.

Professor Carla Treloar, Director of the Social Policy Research Centre at UNSW Sydney said: “This new research shows that the greatest overall increase in people relying on the lowest income support payments from September 2019 to September 2021 were in economically disadvantaged communities. These communities already faced high unemployment, as well as a myriad of other challenges. Let’s give them the chance to recover from the pandemic, rather than push them further into poverty.

“Just because someone has the bad luck to live or work in a community affected by another wave of lockdowns, they have been locked into poverty. Those people and families affected the most will find it incredibly difficult to reconstruct their lives.”

ACOSS recommends that the Government urgently fix the social security, social housing arrangements and employment help to protect people from financial distress and homelessness. The solutions include:

- Immediately extend COVID Disaster Payments, not abolish them, in order to lift incomes for all people without paid work to at least $600 per week, including those in receipt of social security and those without any other income source at all.

- Pass legislation lifting working age income support payments (JobSeeker, Youth Allowance, parenting payments and related income support) to the pension rate, which is just above the poverty line (at least $475pw for single people).

- Index all income support payments twice a year to wage growth as well as prices.

- Extend income support to all without adequate paid work, including temporary visas.

- Increase Commonwealth Rent Assistance by 50%.

- Provide supplementary payments for people with disability or illness, and single parents, recognising the additional costs they face.

- Invest in social housing to address the critical shortfall of supply.

- Introduce a flexible national employment support scheme to support jobs and wages for employers and workers directly or indirectly affected by lockdowns and border closures, which guarantees continued employment and payment of wages at least at COVID Disaster Payment levels.

Mental health conditions by weekly equivalised household income

Those with lower weekly household incomes report higher levels of mental health conditions.

Heart, stroke and vascular diseases, diabetes and arthritis by main income source

Those receiving government pensions/allowances and aged under 65 reported higher levels of heart, stroke and vascular diseases, diabetes and arthritis than those whose main income was wages or salary.