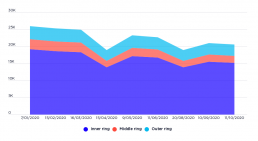

Airbnb listings for entire houses, Sydney, January to October 2020

This graph shows the data for listings from InsideAirbnb for Sydney during the period January to October 2020. It shows that listings for entire homes contracted by 17% since COVID-19 restrictions were introduced, equating to 4,317 dwellings that were presumably available previously for long term lease or purchase. The decline is most pronounced in the inner rings of Sydney. It suggests that, while many of these properties might have been sold, re-occupied by owners, or left unoccupied, there was likely a substantial increase in teh supply of longer term private rental properties in inner-Sydney.

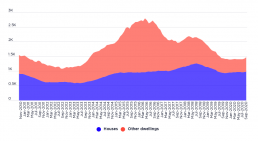

New private dwelling approvals, Greater Brisbane

This graph shows how apartments and units became the main source of new dwellings in the Greater Brisbane area over 2013-14 to 2015-16.

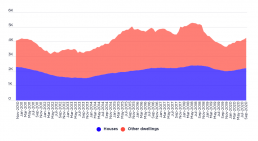

New private dwelling approvals, Greater Melbourne

This graph shows how apartments and units became the dominant source of new dwellings in Greater Melbourne over 2013-14 to 2015-16.

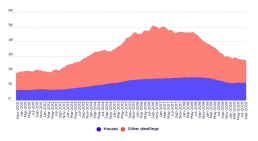

New private dwelling approvals, Greater Sydney

This figure shows how apartments and units became the dominant source of new dwellings in 2013-14 to 2015-16, and have remained the majority since then.

New private dwelling completions, seasonally adjusted, September 2011 to June 2020

This graph reflects a boom in private dwelling construction, corresponding to waves of investor finance over the period. Since 2018, the pipeline of new dwellings has contracted, and particularly since March 2020. There appears to be a reorientation towards detached homes, but given the natural month-to-month fluctuation in apartment and unit approvals, and notwithstanding the months immediately following the implementation of COVID-19 restrictions, it is too soon, given the data within this graph, to determine whether this is a lasting trend.

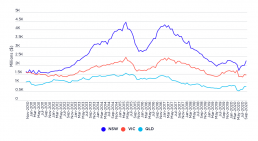

Value of new home loan commitments for investor purchase, seasonally adjusted, November 2010 to September 2020

This graph shows two waves of investor finance for NSW, QLD and Victoria, before and after 2015-16, corresponding with substantial growth in the supply of privately rented dwellings. From the beginning of 2010-11 to the end of 2013-14, approximately 262,000 additional households, and in 2017-18, another 245,000 households, entered the private rental sector, according to the Australian Bureau of Statistics (Housing Occupancy and Costs)

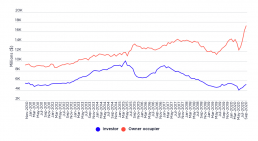

Value of new home loan commitments in Australia, seasonally adjusted, November 2010 to September 2020

This graph shows that the trend before 2017-18 was one in which investor purchasers were receiving a growing share of new home loan commitments (besides a contraction during 2015-16). However, in COVID times, owner-occupier finance has rebounded more sharply than investor finance, which only recovered to pre-pandemic levels as of September 2020.

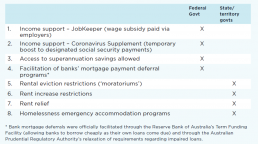

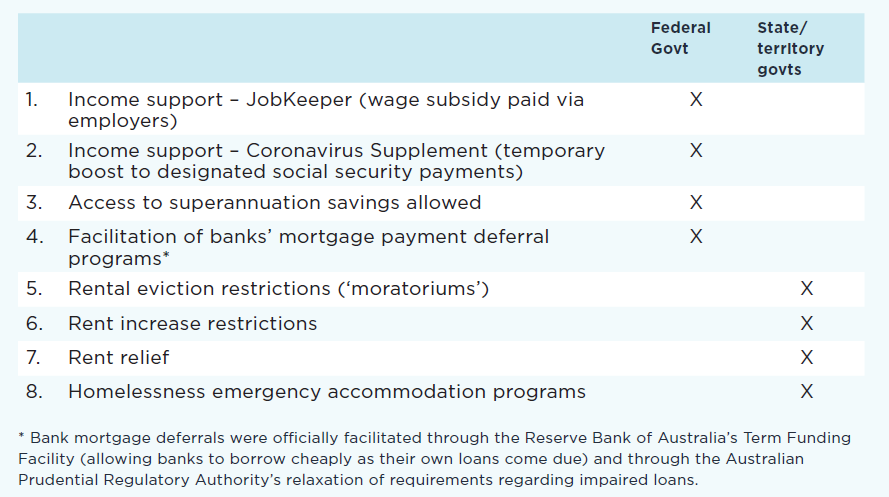

Key pandemic policy innovations relevant to minimising housing market disruption and homelessness in Australia

This table shows the key policy innovations that were introduced in Australia at the start of the COVID-19 pandemic in order to minimise the impact on housing and homelessness. Items 5-8 are the focus of the Poverty and Inequality Partnership report Covid-19: Rental housing and homelessness impacts - an initial analysis

New report shows progress made on homelessness in response to COVID-19 slipping away – tens of thousands face huge rental debts

A new report shows the gains made on reducing homelessness during the pandemic last year are slipping away. It shows less than a third of those assisted with temporary hotel accommodation during the crisis were later transitioned into longer-term affordable housing, mainly due to a shortage of social housing available. At the same time, tens of thousands of people renting across the country now owe mounting rental debts, after having their payments deferred (but not reduced) while eviction moratoriums were in place.

The report - COVID-19 Rental Housing and Homelessness Impacts: an initial analysis – is part of the UNSW Sydney and Australian Council of Social Service’s Poverty and Inequality research partnership.

Australian Council of Social Service CEO, Dr Cassandra Goldie, said:

“During the pandemic, governments did the right thing by increasing income support payments, putting in place eviction moratoriums and providing emergency housing to prevent a sudden surge in homelessness.

“Governments also encouraged landlords to consider rent variations for tenants who had lost income due to COVID-19, but many were unwilling, or agreed only rent deferral rather than rent reduction.

“Now, with emergency tenancy protection and income support being cut back, tens of thousands of people will be facing huge deferred rental debts – putting us at great risk of a worsening homelessness crisis.

Report author, UNSW Sydney Professor Hal Pawson, said:

“Even with the help of increased income support payments and eviction moratoriums last year, our report shows people renting were much harder hit by the pandemic than homeowners. Nationally, renters’ housing costs dropped by only 0.5% on average; mortgage holders, by contrast, typically saw a 5% decline in their housing costs.

“At least a quarter of all private renters lost income during the pandemic, but possibly as few as 8% got a rent variation from their landlord.

“At least 30% of rent variations merely deferred the rent, rather than reduced it. Our report shows there could be at least 75,000 tenants with mounting deferred rent debts across the country.”

James Toomey CEO of Mission Australia, which partnered on the report, said:

“With these huge rental debts mounting and eviction moratoriums ending, many people are deeply worried they will lose their homes and be pushed into homelessness. At the same time, unemployment is above historic norms and the Federal Government has not ruled out cutting the JobSeeker payment back to the brutal old Newstart rate. Income support payments must be set at an adequate rate, and there remains an urgent need for investment in new social and affordable homes if we are to have any hope of addressing rental stress and ending homelessness in Australia.”

Adrian Pisarski, CEO of National Shelter, which also partnered on the report, said:

“State governments acted quickly and on an extraordinary scale to provide emergency accommodation for people who were homeless early in the pandemic, but less than a third of those assisted were later transitioned into longer-term affordable housing.

“People are being left with nowhere to go but a car, someone’s couch or the street. After we saw rough sleeping almost eliminated in several of Australia’s major cities in mid-2020, numbers are once again on the rise. The struggle that state governments have faced in dealing with this situation once again exposes our intensifying shortage of social and affordable housing”

ACOSS CEO Cassandra Goldie concluded:

“Governments, particularly the Federal Government, have the power to prevent this worsening homelessness crisis – to build on their good work during the pandemic and finally get us on track to end homelessness in Australia.

“At the Federal level, the Government can put in place a permanent and adequate level of income support and bolster state social housing construction. A new push to invest in social housing can begin to make good a decade of neglect. It can provide long-term affordable living solutions so that people have a base from which to rebuild their lives, at the same time generating tens of thousands of jobs, supporting our economic recovery from the pandemic.”

More information:

Download the report at: http://povertyandinequality.acoss.org.au/covid-19/housingimpacts/