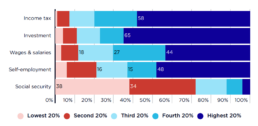

Distribution of income by source (percentage of all income)

This chart shows how the distribution of income by source is distributed unevenly across the household income groups.

2019-20: The highest 20% received 59% of all investment income and a substantial share of own-business income and wages (47% and 43% respectively).. At the other end of the scale, the lowest 20% received over a third of all social security income (37%).

2017-18: The highest 20% received two-thirds of all investment income and a large share of own-business income and wages (48% and 44% respectively). At the other end of the scale, the lowest 20% receives over a third of all social security income (38%).

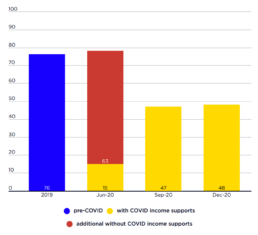

Poverty among JobSeeker recipients with and without COVID income supports (% of all people in poverty)

This graph shows that poverty among people on working age income support payments fell sharply in the recession. It shows that poverty among people in households on Jobseeker Payment fell by four-fifths, from 76% in 2019 to 15% in June 2020.

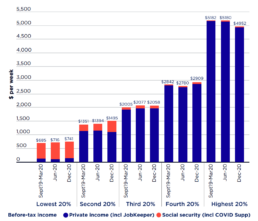

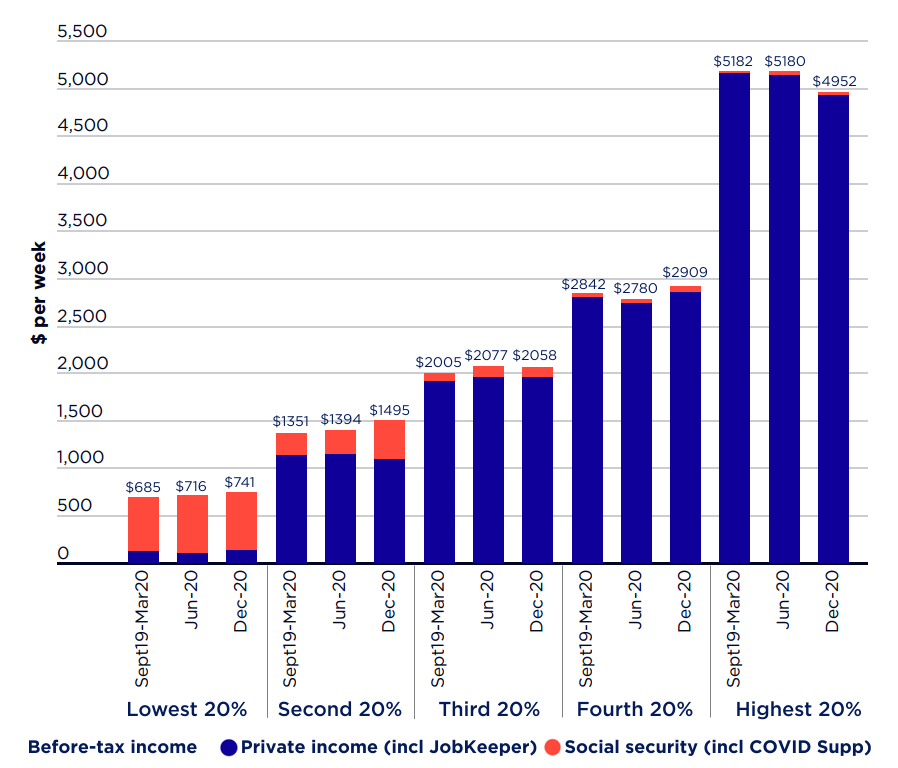

Average before-tax household income ($pw)

This chart shows trends in before-tax incomes for households ranked by private income from March 2020 (just prior to the COVID recession) to June 2020 (when Australia was locked down, and effective unemployment reached 17%) and December 2020 (when most lockdowns had eased and effective unemployment had declined to 7%).

It shows that, from March to December 2020, average before tax incomes:

* Rose from $685pw to $741pw for the lowest 20% of households ranked by income;

* Rose from $2,005pw to $2,058pw for the middle 20%;

* Fell from $5,182 pw to $4,952pw for the highest 20%.

These figures indicate that income inequality declined despite the recession, an extraordinary result given past experience

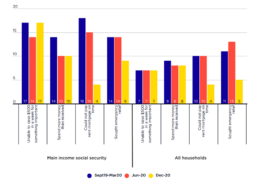

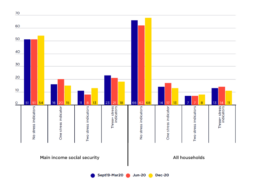

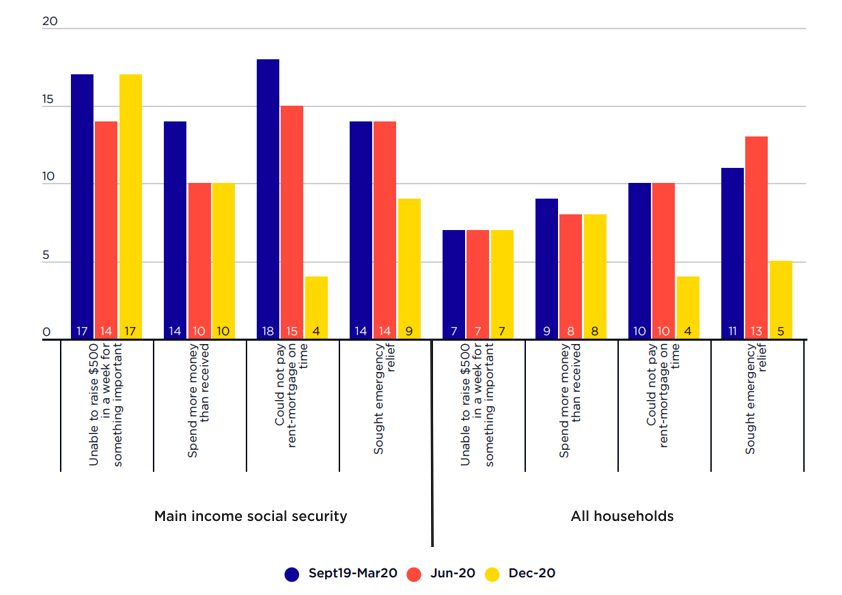

Financial stress among social security recipients and all people (2020)

This graph shows trends in key financial stress indicators.

From September 2019 to December 2020:

* The proportion of people on social security unable to pay their rent or mortgage on time fell from 18% to 4%, while the proportion of the overall population fell from 10% to 4% (aided by rent and mortgage amnesties);

* The proportion of people on social security seeking emergency relief fell from 14% to 9% while the proportion of the overall population fell from 11% to 5%.

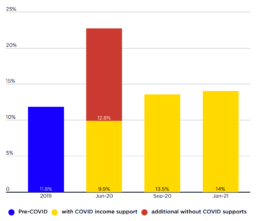

Poverty with and without COVID income supports

These graphs show the number and rate of people in poverty during the COVID recession and early stages of the recovery up to January 2021.

They use the 50% of equivalent disposable household income, and the results have been adjusted to take account of housing costs, and shows the difference that the COVID income support payments (mainly Coronavirus Supplement and JobKeeper Payment) made to the number and rate of people in poverty.

The graphs show that:

* In June 2020, 9.9% of people were below the poverty line, compared with 11.8% in 2019 and 22.7% who would have been in poverty in June 2020 without the new income supports (Figure 8a).

* An estimated 2,613,000 people were in poverty in June 2020, well below the 3,018,000 in 2019, and half the number that would have been in poverty (5,772,000) in June 2020 had COVID income supports not been introduced (Figure 8b).

This confounds the traditional view on the impact of recessions on incomes - if income support payments sit below the poverty line, an increase in unemployment is likely to be associated with an increase in poverty.

The graphs also show that poverty increased during the recovery, as the COVID 19 income supports phased down:

* From 9.9% in the recession in June 2020 to 14% at the end of that year (when the Coronavirus Supplement was reduced to $125pw);

* From 2,613,000 people in June 2020 to 3,820,000 in January 2021 (when the Supplement was reduced further to $75pw).

NAB financial stress index, 2014 to June 2021

This graphs shows trends in the NAB financial stress index from 2014 to the June quarter of 2021.

This measure of financial stress fell sharply in the second quarter of 2020, despite the recession. It then rose sharply in the first two quarters of 2021 among people on low incomes as COVID income supports were reduced and then removed.

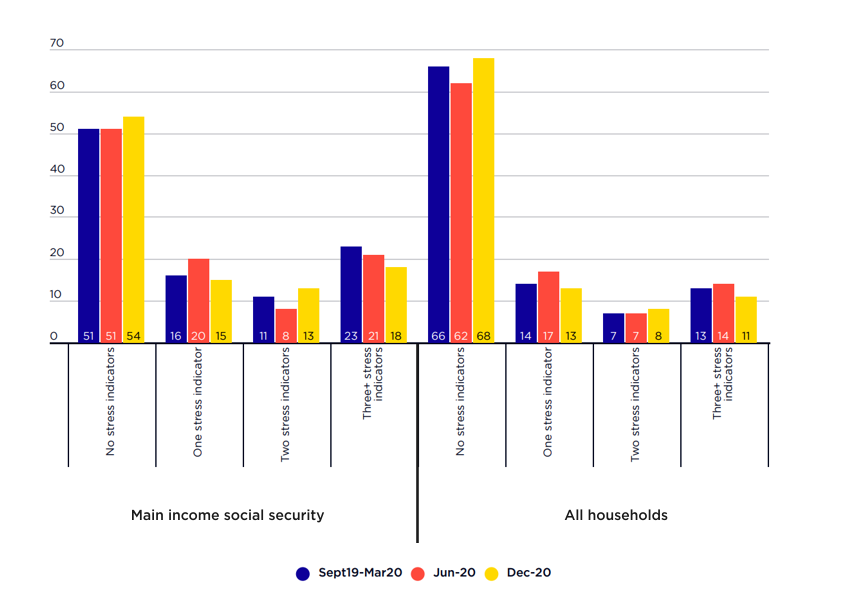

Financial stress in recession and recovery (2020)

This graph compares financial stress indicators among people whose main income was social security and the overall population, before and shortly after the COVID recession. There were significant reductions in financial stress over this period.

Between September 2019 and December 2020:

* The proportion of people reporting the most severe financial stress (three or more indicators) fell from 23% to 18% among those on social security payments and from 13% to 11% among the overall population.

* The proportion with no stress indicators rose from 51% to 54% among those on social security payments and from 66% to 68% among the overall population.

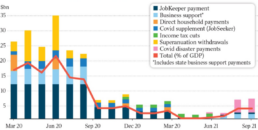

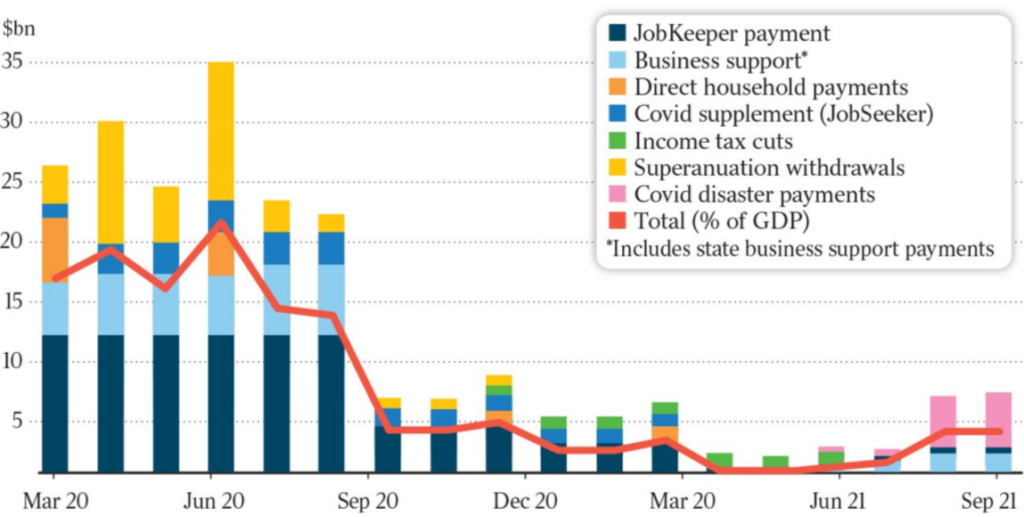

Fiscal stimulus

Source: Cacho C (Chief Economist, Jarden) cited in: Commins P, Targeted stimulus cuts billions off the bill, The Australian 3/9/21

Note: Monthly expenditure on COVID income supports averaged around $20 billion per month from March to September 2020, fell to less than $5 billion per month during the recovery from October 2020 to June 2021, then rose to around $7 billion per month in the second wave from August to September 2021.

This graph shows all the fiscal stimulus measures introduced during the COVID pandemic during 2020 and 2021.

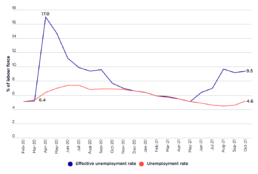

Unemployment rate and effective unemployment rate

This graph compares the unemployment rate with the effective unemployment rate, a composite measure introduced by the Australian Bureau of Statistics during the COVID-19 pandemic made up of unemployed people, employed people who still had a job but worked zero hours for economic reasons, and the reduction in the labour force compared with pre-lockdown levels.

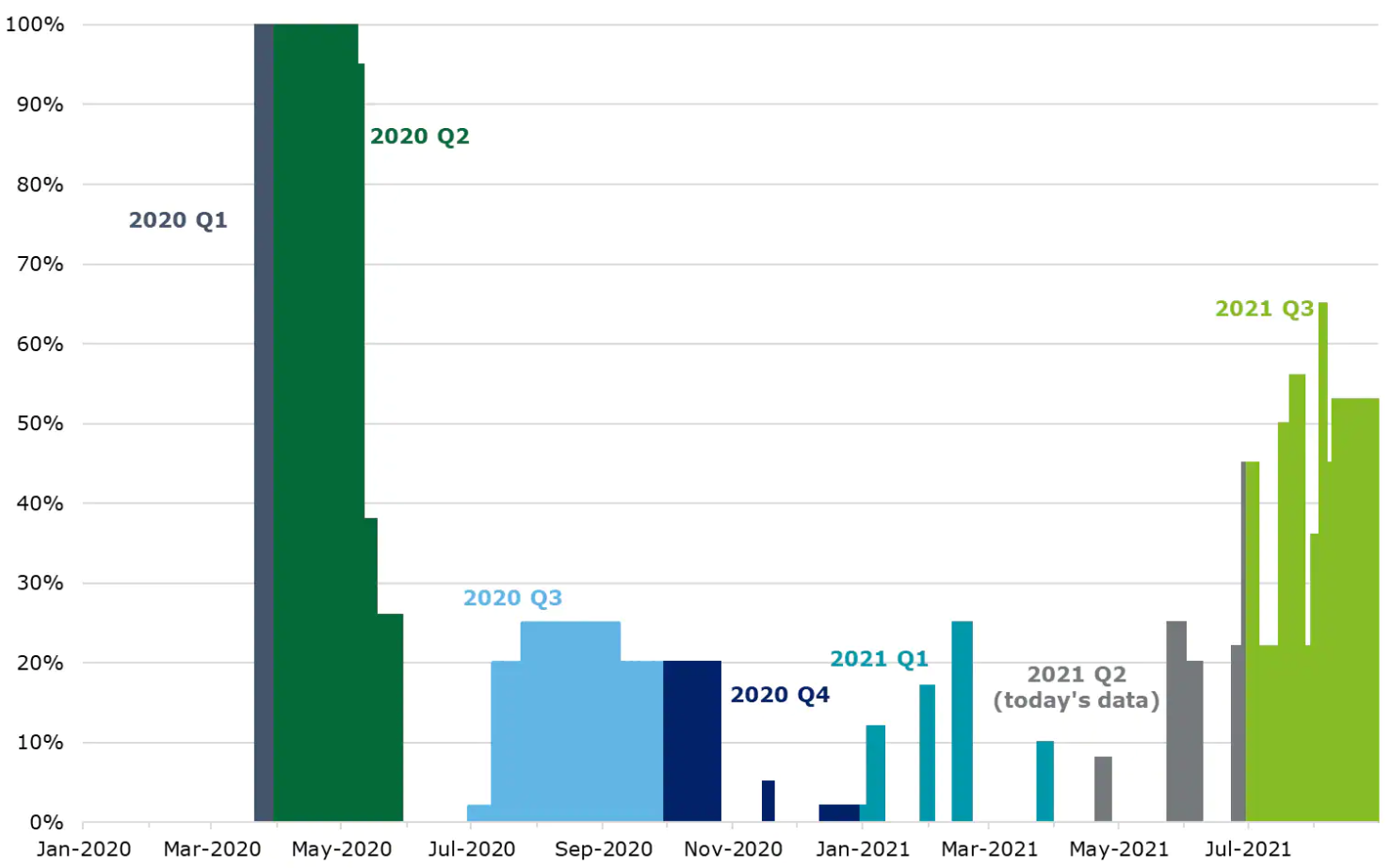

Proportion of all people in lockdown (March 2020 to September 2021)

Source: Derwin J (2021), ‘Australia has avoided another recession for now. But economists warn we’re in ‘the eye of the storm.’ Business Insider 1/9/2021.

This graph shows the proportion of people in Australia who were in lockdowns from Jan 2020 to July 2021.