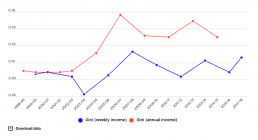

Overall trends in income inequality

This graph shows the overall trends in income inequality from 1999-00 to 2017-18 using the Gini coefficient by both weekly and annual income. A higher Gini represents greater overall inequality. When the weekly income measure is used, the Gini rises from 0.304 to 0.319 between 1999-00 and 2007-08 and ends up at 0.315 in 2017-18. When the annual income measure is used, inequality increases more sharply from 0.305 in 1999-00 to 0.344 in 2007-08, falling back to 0.329 in 2014-15. In theory, we would expect the Gini coefficient for annual income to be lower than that for weekly income, as incomes are smoothed out throughout the year. One explanation for the higher Gini for annual incomes is that fluctuating one-off incomes such as dividends and capital gains were under-reported in the weekly income measure. Another is that the annual income measure does not accurately pick up fluctuations in social security payments through the year. Find out more by reading our methodology page.

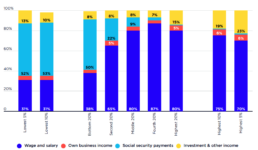

Main income source of each income group

This chart shows the main sources of household income for people ranked by the income of their households. 2019-20: Wages and salaries contributed most of the before-tax income of all income groups except the lowest 20%. Social security payments comprised half the income (50%) of the lowest 20% but contributed less than 10% of the incomes of the highest 60% of households. Investment income only contributed a sizeable share of the incomes of the highest income groups. For example, it contributed 23% of the income of the highest 5%. 2017-18: Wages and salaries represent the main source of income for all income groups except the lowest. Social security payments are the largest income source for the lowest 20% (54% of their income) but these payments comprise 25% or less of total income for all higher-income groups. Investment income only forms a sizeable share of the incomes of the highest income groups, for example 29% of the income of the highest 5%. 2015-16: Wages and salaries…

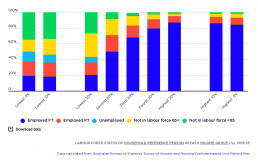

Labour force status of household reference person in each income group

This shows the employment status of all adults in each of the income groups. Only 24% of adults in the lowest 20% have paid employment, and less than half of these workers are in full-time jobs. In the middle 20%, 68% of adult household members are employed, with 42% of these workers in full-time jobs. Typically in these households there is a primary income-earner in full-time paid work and a secondary income-earner in part-time paid work. Within the highest 20%, 87% of adult households members have paid work, with 67% of them in full-time jobs. This suggests that these households are more likely than the middle 20% group to have two full-time wage earners.

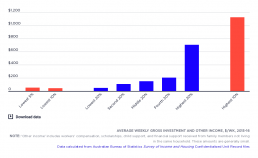

Average weekly before-tax investment and other income

This graph shows the average weekly income received by the various income groups from investment and ‘other income’. The majority of people live in households that receive little or no income from investments, while a few receive large amounts. The middle 20% had an average of $150 per week from investments and other private sources, while the highest 20% had almost five times as much ($705) and the highest 5% had almost eight times as much ($1,125). As a result, despite being a small share of overall income, investment income contributes substantially to overall income inequality.

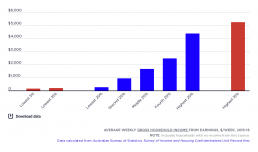

Average weekly gross household income from wages

This shows average weekly incomes from wages (before tax) in each of the income groups. The highest 20% of households receives almost three times the average wages of the middle income group (averaging $4,363 per week before tax compared with $1,645), while the middle 20% receives six times as much as the lowest 20% ($1,645 compared with $256). Differences in average earnings received by household income groups are the result of variations in the proportion of people employed in different household income groups and the number of hours they work (see this graph), and their hourly pay.

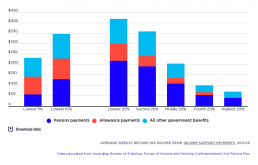

Average weekly before-tax income from income support payments

This shows the average income support payments received by people in the different income groups in 2015-16. The average social security income is $418 per week for the lowest 20%, of which 52% is from pensions and 20% is from allowances. In contrast, just 25% of the social security income of the lowest 5% is pensions and 37% is allowances. This can be explained by the fact that allowances are paid at a much lower rate, so people who receive them are more likely to be found in the lowest 5%. The second 20% receives slightly less from income support payments than the first ($358 on average) due in part to the income-tests applying to allowances and pensions, but receives similar ‘other’ payments ($118) which mostly comprise Family Tax Benefit Part B. Households in the highest 20% income group receive only $69 per week on average in social security payments. While overall income from social security is much lower than earnings, the social security makes a substantial contribution to…

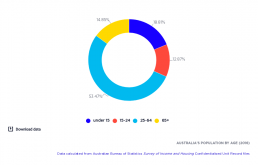

Australia’s population by age

This shows how Australia’s population is divided up by age in 2015-16. Almost two-thirds (66%) of Australia’s population are of working age (15-64 years old), followed by children under 15 years old (19%). Those aged 65 and over make up 15% of the population.

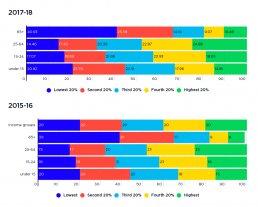

Income distribution of people in households by age

This chart shows where people of different ages are placed in the household income rankings. 2019-20: Older people and children are more likely to be in the lowest 40% while people of working age are more likely to be found in the highest 20% income group. The lowest 40% income group contained 66% of people aged 65+, and 44% of children under 15. Almost half of people of working age (between 16 - 64) were in the highest 40% income group. 2017-18: People aged 64 and over are found towards the lower end of the household income scale. 41% of all older people are in the lowest 20% income group. Adults of working-age – aged between 25-64 - are located higher up the income rankings, with 48% in the highest two income groups. Young people – aged between 15-24 - are located in the middle to upper half of the distribution (with 45% in the middle and fourth 20%). This generally reflects the income of their parents, who are likely to be in their peak wage-earning years. Children under 15…

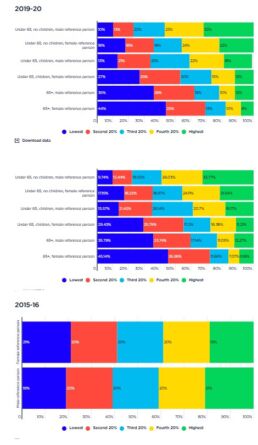

Income distribution of people in households by gender

This graph shows where those identifying as male and female are placed in the household income rankings. Generally, the individual incomes of women are lower than those of men. In 2023, median earnings from paid work (both full- and part-time) for women were 75% of those for men, according to the Australian Bureau of Statistics. However, this website compares income groups based on the income of their household (assuming that incomes are equally shared within households), rather than individual incomes. As a result, income inequality between men and women can be masked; the impacts of gender inequality only become apparent when women live independently of men. 2019-20: Families with a female reference person, especially those with dependent children, were twice as likely (27%) to be in the lowest 20% income group, compared with families with children and a male reference person (13%). Among sole parent families, in which most reference people are women, 38% were in the lowest 20%…

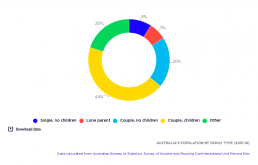

Australia’s population by family type

The largest family type is couples with children, at 44% of all households, followed by couples without children and ‘other’ households (including sibling households, multiple family households, and share households), both at 20%. Single person households (most of whom are over 64 years) comprise 9% of the population, and sole parents, 7%.