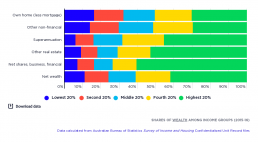

Wealth distribution among income groups

Wealth is more evenly distributed across income groups than across wealth groups. The highest 20% of households by income hold 42% of household wealth, compared with 15% for the middle 20% and 11% for the lowest 20%. The main reason for the more even distribution of wealth among household income groups is the high home ownership rate among older people, who tend to have lower incomes. This is likely that this will change in future as a declining share of older people own their main home The highest 20% income group holds 30% of all wealth in main residences, compared with 17% for the middle 20% income group; and 16% for the lowest 20% income group. Other forms of wealth are much less evenly distributed across household income groups. The highest 20% income group owns 60% of all shares and other financial assets, 53% of investment real estate, and 46% of superannuation wealth.

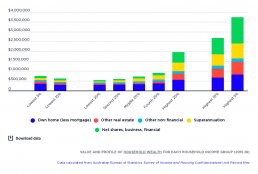

Value and profile of household wealth for each income group

This graph shows the distribution of wealth across income groups. It is more evenly distributed than across wealth groups, due largely to high levels of home ownership among retirees. 2017-18 The wealth of the highest 20% by income is valued at $2,148,000, almost three times as much as the middle 20% and four times as much as the lowest 20%. The average value of wealth in owner-occupied homes is fairly consistent across income groups, with four of the five groups holding no more than $400,000 in wealh in this form. The highest 20% have homes worth an average of $496,000 after mortgage debt is subtracted. Shares and other financial assets are heavily concentrated in the hands of the highest 20% by income. Their average holdings are worht $622,,00 - five times that of the middle 20% ($124,000) and nine times that of the lowest 20% ($73,000). The avearge superannuation wealth of the highest 20% is $496,000, three times that of the middle 20% ($179,000) and nine times that of the lowest…

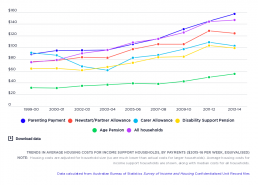

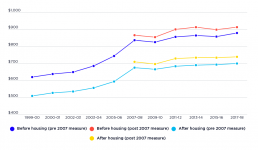

Trends in housing costs by income support payment

This graph shows trends in average housing costs (adjusted for household size) for households reliant on income support payments, by payment, using $2015-16, compared with the median cost for all households. From 2006-08 to 2015-16, median housing costs for all households (after adjusting for inflation and household size) rose from $75 a week in 1999-00 to $115 a week in 2007-08, and then increased by 27% to $146 in 2015-16. The largest housing cost increases from 2007-08 to 2015-16 were experienced by those relying on Parenting Payment (mainly sole parent families). Their average housing costs rose in real terms from $91 per week in 1999-00 to $115 in 2007-08, then increased again by 32% to $152 in 2015-16. Those relying mainly on Newstart Allowance also faced relatively high housing costs, which grew from $75 per week in 1999-00 to $106 in 2007-08, then rose by 28% to $136 in 2015-16. Housing costs for households relying on Disability Support Pension rose from $64 per week in…

Trends in household disposable incomes, 1999-00 to 2017-18

This graph shows trends in median household incomes from 1999-00 to 2017-18, adjusted for inflation using 2017-18 dollars. Because the poverty lines used in this website are benchmarked against median equivalent household disposable income, major changes in this income affects measured poverty levels. This graph shows that median household disposable incomes rose sharply from 1999-00 to the Global Financial Crisis of 2007-08, and thereafter grew much more slowly. This reflects the economic boom conditions from before the Global Financial Crisis, and the sluggish growth afterwards.

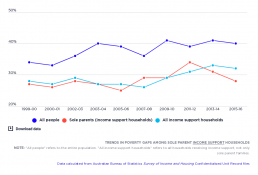

Trends in poverty gaps among people in sole parent income support households

This graph compares poverty gaps (the difference between the average incomes of those below the poverty line and the poverty line) for sole parents in income support households with firstly those for all people in income support households, and, secondly, the whole population living below the poverty line. Generally, the poverty gaps for sole parents in income support households are very similar to those in income support households generally, reflecting the fact that the maximum rate of Parenting Payment Single is greater than Newstart and other allowance payments, but less than pension payments. The poverty gap for sole parents in income support households rose from 28% of the poverty line in 1999-00 to 45% in 2011, then declined to 29% in 2015-16.

Trends in poverty among sole parents in income support households

This graph shows the poverty rate among sole parents in income support households in which all children are aged under 15 as a percentage of all households, taking into account housing costs. By only including households with children under the age of 15, it controls for the earnings of teenage and adult children. While the poverty rate among families with a youngest child aged 0-4 years remained stable, rising only marginally from 57% in 2011-12 to 58% in 2012-13, poverty rates rose substantially among families whose youngest child was 5-9 years old, from 47% to 55%; and for those whose youngest child was 10-14 years old, from 51% to 67%. This reflects the impact of the introduction of ‘welfare to work’ policies, and the movement of sole parents from pension payments to lower allowance payments.

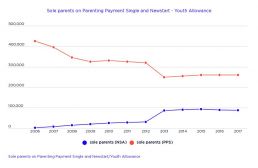

Trends in sole parents receiving different payments

This graph shows the trends in the number of sole parents receiving Newstart Allowance and the number of sole parents receiving Parenting Payment Single. The number of sole parents receiving Parenting Payment declined from 425,000 in 2006 to 260,000 in 2015, with the largest reduction being the fall from 320,000 to 250,000 in 2013 when the last remaining sole parents with a youngest child aged 8 or more (those who had received Parenting Payment before 2006) were shifted on to Newstart Allowance or other payments, or else stopped receiving income support payments. The number of sole parents receiving Newstart Allowance rose from close to zero in 2006 to 88,000 in 2015.

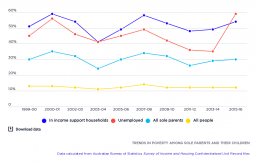

Trends in poverty among sole parents

This graph displays the trends in poverty among sole parents, based on the 50% median income poverty line and as a percentage of all people in sole parent families, taking into account housing costs. It shows that sole parents had consistently higher poverty rates than the population-wide level throughout the period. The rate fluctuates in a ragged style, falling from 31% in 1999-00 to 25% in 2002-03, rising to 46% in 2007-08, falling to 26% in 2011-12, then rising again to 30% in 2016-17. This pattern can be partially explained by changes in median household incomes and housing costs for sole parents. The poverty rate among sole parents in income support households (relying primarily on either Parenting Payment or Newstart Allowance) followed a similar ragged pattern but at higher levels. This is due to a large number of sole parents living in income support households (varying between 53% of all sole parents in 1999-00 to 44% in 2015-16). Although these sole parents had lower…

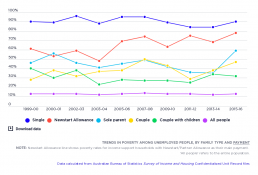

Trends in poverty among unemployed people

This graph displays trends in poverty among people without paid work, by family type and payment according to the 50% median income poverty line and as a percentage of all unemployed people, taking into account the cost of housing. It shows that poverty among unemployed people was consistently higher than the population-wide poverty rate from 1999-00 to 2015-16. The poverty rate among unemployed single people was particularly high, at 90% at both the beginning and end of this period, reflecting the level of Newstart and Youth Allowances. Recipients of Newstart Allowance also had elevated poverty rates, albeit lower than those for single unemployed people. The differences between the two groups is family status (Newstart recipients includes those who are partnered) and employment status (approximately 1 in 5 Newstart recipients had part-time employment). There was also a marked increase in poverty amongst Newstart recipients from its already high level of 61% in 1999-00 to 78% in…