Average wealth per adult in 2020

According to Credit Suisse’s Global Wealth Report, the average wealth of Australian households was $628,000 per adult in 2020, the fourth highest in the world behind Switzerland, the United States and Hong Kong (North America as shown on the graph refers to the region, as does Asia-Pacific and Europe).

Average wealth of households by age, as a percentage of the average wealth of all (%)

This graph shows that wealth inequality has increased across generations since 2003, especially in the distribution of owner-occupied housing. As a proportion of the average value of owner-occupied homes held across all age groups: • The average value held in households with a reference person under 35 years fell from 31% in 2003 to 26% in 2021; • That of those aged 35-44 years fell from 82% in 2003 to 69%; • That of those aged 64 years rose from 140% in 2003 to 144%.

The Wealth Paradox - wealth inequality and the housing crisis

A new report being launched today by the ACOSS/UNSW Sydney Poverty and Inequality Partnership, The wealth inequality pandemic: COVID and wealth inequality confirms that even though Australians are now, on average, the fourth richest people in the world, the distribution of our wealth remains hugely unequal. Our overall household wealth has grown as much in the last 3 years as it did in the previous fifteen, despite the COVID-19 pandemic and the recession in 2020, thanks mainly to the soaring cost of residential properties across the country during that same period. Soaring housing prices and their impact Over two-thirds (69%) of the overall increase in household wealth during the pandemic was in residential property, which rose in value by 22% through the year to December 2021 - the highest annual increase in 35 years. Rising house prices increase the divide between people who bought their homes when they were more affordable, and younger people and those on low and modest incomes who…

Wealth inequality (Gini coefficient)

This graph shows trends in a summary measure of inequality, the ‘Gini coefficient’. The Gini varies across a range from zero (equal wealth) to one (where all wealth is held by a single household). It rose sharply from 0.573 in 2003 to 0.624 in 2018; and then declined slightly to 0.613 by 2021, close to the level reached around 2016.

Share of wealth held by households ranked by wealth (% in 2021)

Consistent with the findings of our Inequality in Australia 2020 report, wealth is still very unequally distributed in 2021-22. * The highest 10% of households by wealth has an average of $6.1 million or 46% of all wealth. *The next 30% have an average of $1.7 million or 38% of all wealth. * That leaves the majority – the lower 60% - with $376,000 or just 17% of all wealth.

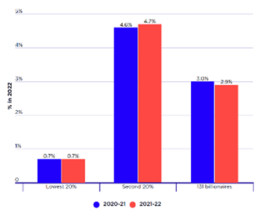

Share of all wealth held by 131 billionaires compared with low-wealth groups (%)

The 131 billionaires comprised 0.001% of the population yet held 2.9% of all household wealth in 2021, a decline from 3% in 2020. This graph shows that they held more wealth among them than the lower 20% of households ranked by wealth (who held 0.7% of all wealth) and somewhat less than the second-lowest 20% (with 4.7%). This suggests that 131 individuals held almost as much wealth between them as the 2.8 million households in the lowest 30% ranked by wealth.

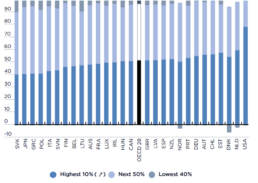

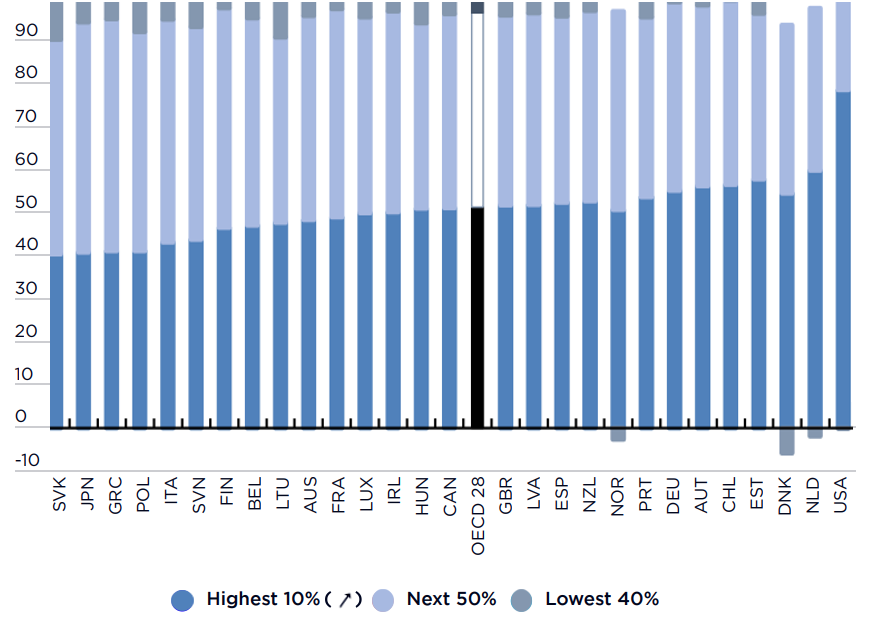

Shares of overall wealth held by the lowest 40%, middle 50% and highest 10% around 2018 (%)

Source: OECD (2021) Inequalities in household wealth and financial insecurity of households, OECD Policy Insight. Note: Households are ranked according to wealth.

The level of wealth inequality in Australia around 2018 (before the pandemic) was somewhat below the average among 28 wealthy nations surveyed by the OECD. The highest 10% of households ranked by wealth held approximately 45% of all wealth in Australia compared with an OECD average of approximately 50%.

The high level of home ownership and housing wealth in Australia is a major reason for this.

Source: OECD (2021) Inequalities in household wealth and financial insecurity of households, OECD Policy Insight. Note: Households are ranked according to wealth.

The level of wealth inequality in Australia around 2018 (before the pandemic) was somewhat below the average among 28 wealthy nations surveyed by the OECD. The highest 10% of households ranked by wealth held approximately 45% of all wealth in Australia compared with an OECD average of approximately 50%.

The high level of home ownership and housing wealth in Australia is a major reason for this.

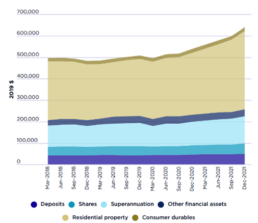

Household wealth per capita (2019 dollars)

While the COVID recession in March 2020 at first reduced household wealth through declines in share and housing prices, a combination of lockdowns, public income support, and low interest rates dramatically lifted household saving and wealth from mid-2020 through to December 2021. The largest contributor to this increase in wealth was a sharp rise in housing prices, as shown on this graph.

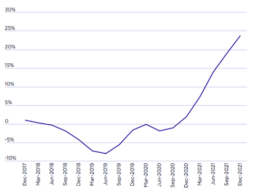

Cumulative increase in capital city dwelling prices 2017 – 2021

This graph shows that average capital city home purchase prices rose by 3% through 2020, despite dipping slightly in the recession. They then increased by 22% the following year to finish 24% above September 2017 values.